How to Rebuild Your Credit and Increase Your Score

Rebuilding your credit after filing for bankruptcy or following unfortunate financial issues can seem like an uphill battle. Potential lenders often shy away from consumers with poor credit ratings, making it harder for those consumers to rebuild credit and raise their scores. If you’re looking to boost your score high enough to have lenders want to approve you for loans and to enjoy lower interest rates, then use these simple tips for getting your credit back on track.

1 – Understand Why You Need a Good Credit Score

Lenders use your credit score to judge your credit worthiness. Your credit report shows how well you handle your financial obligations. A potential lender will want to know how likely you will be to pay back your debts and if you’ll be on time with those payments. Consumers with the highest credit scores are deemed to be the least risk for potential lenders.

2 – Get Free Copies at AnnualCreditReport.com

The first step in rebuilding your credit is finding out where you stand. Many consumers don’t know that you can access your credit reports from all three credit reporting agencies online free of charge once each year at annualcreditreport.com. However, you will have to pay to see your credit score. This usually costs under $10.

Carefully review your reports from each agency and check for mistakes. Save copies of your reports on your hard-drive so you can access them again throughout the year should you need to. Be wary of imposter sites attempting to charge you to view your credit reports.

3 – Get to Know the Fair Credit Reporting Act

Consumers do have rights when it comes to their credit. For instance, there are limits to the amount of time negative information can remain on your credit report. Bankruptcies can remain from 7 to 10 years, repossessions for up to 7 years, collection accounts no more than 7.5 years from the original debt’s delinquency date, and late payments only for 7 years starting from the original date of missed payment.

If negative information is appearing on your report beyond the date it should have been removed you need to take action. Take some time to read about your credit rights under the Fair Credit Reporting Act and use that knowledge to protect yourself.

4 – Know How to Handle Debt Collectors

If you’ve already got an account or multiple accounts in collection, then odds are your score is fair to low. Paying less than you owe back to those debt collectors won’t affect your score so try to bargain with your debtors if possible. Collection agencies will often accept a plan that allows you to pay back less then what you originally owed. Since they buy consumer debt discounted, they still make money.

Never agree to pay back a loan you aren’t sure you really owe on. If a debt collection agency tries to get you to claim responsibility, never do so over the phone. Get all agreements in writing. Consumers are also protected from being harassed by debt collectors. Read up on your rights and stand up for yourself if a debt collector is harassing you about debt.

5 – Pay Every Bill on Time

Late and missed payments are no doubt what earned you the low score you have now in the first place. When rebuilding your credit, never miss a payment. Pay all of your bills on or ahead of time. While it won’t make your credit score jump up overnight, paying your bills regularly is one of the best ways to improve your score over time.

6 – Pay Down Credit Debt

Even if you aren’t missing payments, having high balances on your credit cards can lower your credit score. For instance, say you have a credit card with a 1,000 dollar limit and are trying to help your credit by using it often. If your balance is sitting right at $800, then your debt to credit ratio is in the danger zone. Having cards this close to being maxed out will hurt your credit score, even if you’re making all of your payments on time. Watch your debt to credit ratio carefully as the better it is the higher your credit score can be.

You might also be interested in...

-

7 Steps To Choosing Health Insurance

7 Steps To Choosing Health Insurance

-

8 Steps to Protecting Yourself Against Identity Theft

8 Steps to Protecting Yourself Against Identity Theft

-

Life Insurance You Can Afford

Life Insurance You Can Afford

-

Are Negative Habits Keeping You From Your Financial Goals?

Are Negative Habits Keeping You From Your Financial Goals?

-

Best Retirement Tips for the Younger Generations

Best Retirement Tips for the Younger Generations

-

Calculating Life Insurance Needs

Calculating Life Insurance Needs

-

Can You Climb Your Mountain of Debt?

Can You Climb Your Mountain of Debt?

-

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

-

Eating On A Tight Budget

Eating On A Tight Budget

-

Five Costly Disasters Your Auto Insurance May Not Cover

Five Costly Disasters Your Auto Insurance May Not Cover

-

Five Practical Steps to Repair Your Credit

Five Practical Steps to Repair Your Credit

-

Five Ways to Cut Back on Your Grocery Bills

Five Ways to Cut Back on Your Grocery Bills

-

Four Bad Financial Habits You Need To Break Now

Four Bad Financial Habits You Need To Break Now

-

Getting Out of Debt: Start Taking Control of Your Finances Again

Getting Out of Debt: Start Taking Control of Your Finances Again

-

Good Financial Habits

Good Financial Habits

-

How To Deal With Debt During A Divorce

How To Deal With Debt During A Divorce

-

How To Get By On Social Security

How To Get By On Social Security

-

How to Host an Inexpensive Dinner Party

How to Host an Inexpensive Dinner Party

-

How to Rebuild Your Credit and Increase Your Score

How to Rebuild Your Credit and Increase Your Score

-

Insurance Myths

Insurance Myths

-

Is it Worth it to Get a Credit Monitoring Service?

Is it Worth it to Get a Credit Monitoring Service?

-

Making Life Transitions

Making Life Transitions

-

The Pros And Cons Of HARP Refinance

The Pros And Cons Of HARP Refinance

-

Ten Essential Tips for Managing Your Personal Finances

Ten Essential Tips for Managing Your Personal Finances

-

The Importance of Life Insurance You Can Afford

The Importance of Life Insurance You Can Afford

-

Top Financial Mistakes That Can Spoil Your Retirement

Top Financial Mistakes That Can Spoil Your Retirement

-

Top Ten Cheap Ways to Keep Your Kids Entertained

Top Ten Cheap Ways to Keep Your Kids Entertained

-

What's the Point of Points?

What's the Point of Points?

-

4 Ways To Treat Rosacea Naturally

4 Ways To Treat Rosacea Naturally

-

4 Natural Remedies For Varicose Veins

4 Natural Remedies For Varicose Veins

-

8 Ways To Grocery Shop On A Budget

8 Ways To Grocery Shop On A Budget

-

The Holidays On A Budget

The Holidays On A Budget

-

Tips For Women On Saving For Retirement

Tips For Women On Saving For Retirement

-

Home Remedies For Heartburn

Home Remedies For Heartburn

-

8 Great Uses For Tea Tree Oil

8 Great Uses For Tea Tree Oil

-

The Best Natural Treatments For Sinus Sufferers

The Best Natural Treatments For Sinus Sufferers

-

Old Medical Hacks That Still Work

Old Medical Hacks That Still Work

-

How To Shop Healthy On A Budget

How To Shop Healthy On A Budget

-

The Best Home Remedies For Sunburn

The Best Home Remedies For Sunburn

-

Charitable Giving On A Budget

Charitable Giving On A Budget

-

Money-Saving Tips That Actually Work

Money-Saving Tips That Actually Work

-

10 Ideas For Budget-Friendly Family Fun

10 Ideas For Budget-Friendly Family Fun

-

Can a Reverse Mortgage Save Your Monthly Budget?

Can a Reverse Mortgage Save Your Monthly Budget?

-

How to Get Free Money For College

How to Get Free Money For College

-

How To Have A Humble Holiday

How To Have A Humble Holiday

-

Top 4 Ways To Save For College Education

Top 4 Ways To Save For College Education

-

Can you borrow money from a life insurance policy?

Can you borrow money from a life insurance policy?

-

Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

-

Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

-

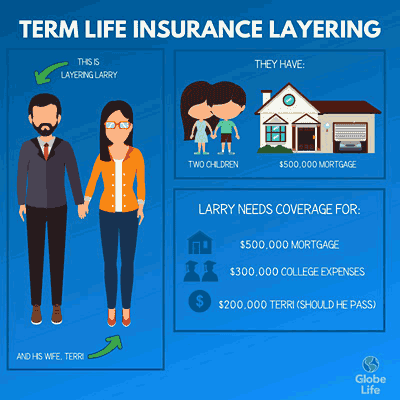

Layering Term Life Insurance Could Save You Money

Layering Term Life Insurance Could Save You Money

-

5 Tips for Finding Life Insurance That Fits Your Budget

5 Tips for Finding Life Insurance That Fits Your Budget

-

Why is Life Insurance Important for Someone Getting a Mortgage?

Why is Life Insurance Important for Someone Getting a Mortgage?

-

Can Getting a Life Insurance Quote Affect My Credit Score?

Can Getting a Life Insurance Quote Affect My Credit Score?

-

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

-

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from