Are Negative Habits Keeping You From Your Financial Goals?

Stress over finances is a leading cause of depression, marital problems and even divorce. Feeling anxiety over money can leave you feeling helpless and insecure about your future. Are your bad money habits partially to blame? If so, then you have the power to turn your finances around. Read on to learn five habits that may be keeping you from reaching your financial goals…

1. Not keeping a monthly budget

1. Not keeping a monthly budget

No one habit contributes more to financial success than making and sticking to a monthly budget. First of all, a monthly budget forces you to face the facts about your finances. This will help you make realistic choices concerning what you can and cannot afford. Second, a monthly budget enables you to track where your money is going. You can pinpoint all the unnecessary purchases that are ruining your finances, and cut them out.

Finally, a monthly budget helps you set (and reach) financial goals. Set aside a payment as part of your monthly budget that will go into savings or towards paying down those higher balances on your credit cards. Once you've allotted the money that way and planned the rest of your monthly spending around it, it's much easier for you to carry through.

2. Making late payments

Just one late payment can wreck your finances, taking you further from your financial goals. Paying a credit card payment late usually results in a hefty late fee. Even worse, it can cause your annual percentage rate to rise, resulting in higher interest payments. If the late payment is for a car, the same consequences will apply, just on a larger (aka more expensive) scale.

Furthermore, payment history accounting for 35% of your total credit score, so you could be paying for that one late payment in the form of higher interest rates on any charged purchase for a long time to come. If financial stability is your goal, work at making all of your payments on time every month.

3. Chasing the "next best thing"

Are you constantly trading in your car, cell phone, etc. for a newer, more expensive model? If so, then you'll always be paying top price for goods and you'll never catch up financially unless you earn a hefty salary. Usually, when a hot new product hits the market, the price is very high. Sellers often anticipate that consumers will be too excited to wait. A product that is on the cutting edge of technology now could be run–of–the–mill in a few years.

When the first electronic readers came out, they cost well over $500 dollars. Now, just a few years later, you can get the most state–of–the–art e–reader for less than a hundred. If you're one of those consumers who is patient, the price will often come down after the initial novelty wears off. Waiting a few months to a year could result in a savings of hundreds of dollars per item. Not to mention the fact that you can avoid flash–in–the–pan products that turn into an expensive buyer's remorse.

4. Spending beyond your means

We're all tempted to buy things that we really can't afford. It's especially tempting when you can just charge it and pay it off later. Before you buy that 60–inch HDTV or give in to that all–Italian leather living room set, take a moment to consider how practical your purchase really is. Credit card interest rates can sometimes get very high, as mentioned above.

Calculate how long it will take you to actually pay for the luxury item you're considering. Now, think about how much more it will really cost you to actually pay it off, once you add in all those months of interest. Instead of charging a bunch of expensive items you can't really afford, consider saving for the item instead and paying in cash. If you can't afford to do that and the item is not an essential, then maybe you don't need to buy it after all.

You might also be interested in...

-

7 Steps To Choosing Health Insurance

7 Steps To Choosing Health Insurance

-

8 Steps to Protecting Yourself Against Identity Theft

8 Steps to Protecting Yourself Against Identity Theft

-

Life Insurance You Can Afford

Life Insurance You Can Afford

-

Are Negative Habits Keeping You From Your Financial Goals?

Are Negative Habits Keeping You From Your Financial Goals?

-

Best Retirement Tips for the Younger Generations

Best Retirement Tips for the Younger Generations

-

Calculating Life Insurance Needs

Calculating Life Insurance Needs

-

Can You Climb Your Mountain of Debt?

Can You Climb Your Mountain of Debt?

-

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

-

Eating On A Tight Budget

Eating On A Tight Budget

-

Five Costly Disasters Your Auto Insurance May Not Cover

Five Costly Disasters Your Auto Insurance May Not Cover

-

Five Practical Steps to Repair Your Credit

Five Practical Steps to Repair Your Credit

-

Five Ways to Cut Back on Your Grocery Bills

Five Ways to Cut Back on Your Grocery Bills

-

Four Bad Financial Habits You Need To Break Now

Four Bad Financial Habits You Need To Break Now

-

Getting Out of Debt: Start Taking Control of Your Finances Again

Getting Out of Debt: Start Taking Control of Your Finances Again

-

Good Financial Habits

Good Financial Habits

-

How To Deal With Debt During A Divorce

How To Deal With Debt During A Divorce

-

How To Get By On Social Security

How To Get By On Social Security

-

How to Host an Inexpensive Dinner Party

How to Host an Inexpensive Dinner Party

-

How to Rebuild Your Credit and Increase Your Score

How to Rebuild Your Credit and Increase Your Score

-

Insurance Myths

Insurance Myths

-

Is it Worth it to Get a Credit Monitoring Service?

Is it Worth it to Get a Credit Monitoring Service?

-

Making Life Transitions

Making Life Transitions

-

The Pros And Cons Of HARP Refinance

The Pros And Cons Of HARP Refinance

-

Ten Essential Tips for Managing Your Personal Finances

Ten Essential Tips for Managing Your Personal Finances

-

The Importance of Life Insurance You Can Afford

The Importance of Life Insurance You Can Afford

-

Top Financial Mistakes That Can Spoil Your Retirement

Top Financial Mistakes That Can Spoil Your Retirement

-

Top Ten Cheap Ways to Keep Your Kids Entertained

Top Ten Cheap Ways to Keep Your Kids Entertained

-

What's the Point of Points?

What's the Point of Points?

-

4 Ways To Treat Rosacea Naturally

4 Ways To Treat Rosacea Naturally

-

4 Natural Remedies For Varicose Veins

4 Natural Remedies For Varicose Veins

-

8 Ways To Grocery Shop On A Budget

8 Ways To Grocery Shop On A Budget

-

The Holidays On A Budget

The Holidays On A Budget

-

Tips For Women On Saving For Retirement

Tips For Women On Saving For Retirement

-

Home Remedies For Heartburn

Home Remedies For Heartburn

-

8 Great Uses For Tea Tree Oil

8 Great Uses For Tea Tree Oil

-

The Best Natural Treatments For Sinus Sufferers

The Best Natural Treatments For Sinus Sufferers

-

Old Medical Hacks That Still Work

Old Medical Hacks That Still Work

-

How To Shop Healthy On A Budget

How To Shop Healthy On A Budget

-

The Best Home Remedies For Sunburn

The Best Home Remedies For Sunburn

-

Charitable Giving On A Budget

Charitable Giving On A Budget

-

Money-Saving Tips That Actually Work

Money-Saving Tips That Actually Work

-

10 Ideas For Budget-Friendly Family Fun

10 Ideas For Budget-Friendly Family Fun

-

Can a Reverse Mortgage Save Your Monthly Budget?

Can a Reverse Mortgage Save Your Monthly Budget?

-

How to Get Free Money For College

How to Get Free Money For College

-

How To Have A Humble Holiday

How To Have A Humble Holiday

-

Top 4 Ways To Save For College Education

Top 4 Ways To Save For College Education

-

Can you borrow money from a life insurance policy?

Can you borrow money from a life insurance policy?

-

Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

-

Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

-

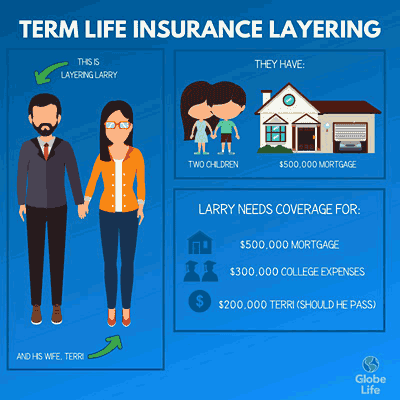

Layering Term Life Insurance Could Save You Money

Layering Term Life Insurance Could Save You Money

-

5 Tips for Finding Life Insurance That Fits Your Budget

5 Tips for Finding Life Insurance That Fits Your Budget

-

Why is Life Insurance Important for Someone Getting a Mortgage?

Why is Life Insurance Important for Someone Getting a Mortgage?

-

Can Getting a Life Insurance Quote Affect My Credit Score?

Can Getting a Life Insurance Quote Affect My Credit Score?

-

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

-

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from