Can you borrow money from a life insurance policy?

Borrowing Money from a Life Insurance Policy

Though the primary focus of life insurance is to provide a benefit to the family of a lost loved one, some policies could add enhancements to a financial portfolio. If you are familiar with life insurance, you may know the term “cash value,” or the ability to borrow from a policy if you have paid a certain amount of premiums. This could be a temporary solution to financial emergencies, but it should require great consideration beforehand so you don’t put your investment at risk.

Can You Borrow Money From a Life Insurance Policy?

Not all life insurance policies build cash value, such as a term life policy. Term life insurance rates are typically less expensive than whole life and offer just the death benefit, not cash value. However, a whole life or universal life insurance policy may offer a cash value benefit, which may allow you to take out a policy loan.

What are the Advantages and Disadvantages of a Policy

Before you jump in and take a loan out against a policy, consider if taking funds from your life insurance policy makes sense for your situation. In addition to weighing the pros and cons below, speak with your insurance company about how taking out a loan will impact your policy.

Advantages:

- No lengthy application process like other loans

- If you have built up cash value, you can borrow without a credit check

- Policy reports do not show up on your credit report unlike other loans

- Policy loans typically have lower interest rates

- Repay the loan on a schedule you set

- You can chose not to repay the loan and just deduct the amount due from the beneficiary’s benefit

Disadvantages:

- Must have cash value built up which may take years from policy start date

- Risk a reduced death benefit for your beneficiary if loan is not repaid

- Risk losing your policy if the interest and unpaid loan amount total more than the remaining cash value

How Does a Policy Loan Work?

When you borrow against your cash value from a life insurance policy, the insurance company uses the benefit as collateral. In other words, if you pay back the loan plus interest in full, your policy benefit will go back to the original amount you bought it for. However, if you do not pay it back, the company will deduct the loan amount plus interest from the policy benefit.

When Can You Take Out a Policy Loan?

You must build up the cash value before you can take out the money. Contact your life insurance representative and they will be able to tell you what your cash value is. You should also discuss how taking out the loan will impact your policy.

What Should I Consider When Taking Out a Policy Loan?

If you do not want to jeopardize your life insurance policy, consider the following when taking out a loan.

- How will taking out this loan impact my life insurance policy? Will I put my beneficiary’s death benefit at risk?

- Aside from the interest, are there any other fees or costs I need to know about?

- I should create a mock budget and schedule on how I will pay the loan back to ensure this is feasible.

Borrowing from a life insurance policy should be treated the same as taking out a loan from the bank – with due diligence. It is important to remember the primary reason for a life insurance policy is to take care of your beneficiaries should something happen to you. However, emergencies happen, so having cash value available could be a huge help in financial adversity. Before taking out a policy loan, you should gather your research and consider every angle.

You might also be interested in...

-

7 Steps To Choosing Health Insurance

7 Steps To Choosing Health Insurance

-

8 Steps to Protecting Yourself Against Identity Theft

8 Steps to Protecting Yourself Against Identity Theft

-

Life Insurance You Can Afford

Life Insurance You Can Afford

-

Are Negative Habits Keeping You From Your Financial Goals?

Are Negative Habits Keeping You From Your Financial Goals?

-

Best Retirement Tips for the Younger Generations

Best Retirement Tips for the Younger Generations

-

Calculating Life Insurance Needs

Calculating Life Insurance Needs

-

Can You Climb Your Mountain of Debt?

Can You Climb Your Mountain of Debt?

-

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

-

Eating On A Tight Budget

Eating On A Tight Budget

-

Five Costly Disasters Your Auto Insurance May Not Cover

Five Costly Disasters Your Auto Insurance May Not Cover

-

Five Practical Steps to Repair Your Credit

Five Practical Steps to Repair Your Credit

-

Five Ways to Cut Back on Your Grocery Bills

Five Ways to Cut Back on Your Grocery Bills

-

Four Bad Financial Habits You Need To Break Now

Four Bad Financial Habits You Need To Break Now

-

Getting Out of Debt: Start Taking Control of Your Finances Again

Getting Out of Debt: Start Taking Control of Your Finances Again

-

Good Financial Habits

Good Financial Habits

-

How To Deal With Debt During A Divorce

How To Deal With Debt During A Divorce

-

How To Get By On Social Security

How To Get By On Social Security

-

How to Host an Inexpensive Dinner Party

How to Host an Inexpensive Dinner Party

-

How to Rebuild Your Credit and Increase Your Score

How to Rebuild Your Credit and Increase Your Score

-

Insurance Myths

Insurance Myths

-

Is it Worth it to Get a Credit Monitoring Service?

Is it Worth it to Get a Credit Monitoring Service?

-

Making Life Transitions

Making Life Transitions

-

The Pros And Cons Of HARP Refinance

The Pros And Cons Of HARP Refinance

-

Ten Essential Tips for Managing Your Personal Finances

Ten Essential Tips for Managing Your Personal Finances

-

The Importance of Life Insurance You Can Afford

The Importance of Life Insurance You Can Afford

-

Top Financial Mistakes That Can Spoil Your Retirement

Top Financial Mistakes That Can Spoil Your Retirement

-

Top Ten Cheap Ways to Keep Your Kids Entertained

Top Ten Cheap Ways to Keep Your Kids Entertained

-

What's the Point of Points?

What's the Point of Points?

-

4 Ways To Treat Rosacea Naturally

4 Ways To Treat Rosacea Naturally

-

4 Natural Remedies For Varicose Veins

4 Natural Remedies For Varicose Veins

-

8 Ways To Grocery Shop On A Budget

8 Ways To Grocery Shop On A Budget

-

The Holidays On A Budget

The Holidays On A Budget

-

Tips For Women On Saving For Retirement

Tips For Women On Saving For Retirement

-

Home Remedies For Heartburn

Home Remedies For Heartburn

-

8 Great Uses For Tea Tree Oil

8 Great Uses For Tea Tree Oil

-

The Best Natural Treatments For Sinus Sufferers

The Best Natural Treatments For Sinus Sufferers

-

Old Medical Hacks That Still Work

Old Medical Hacks That Still Work

-

How To Shop Healthy On A Budget

How To Shop Healthy On A Budget

-

The Best Home Remedies For Sunburn

The Best Home Remedies For Sunburn

-

Charitable Giving On A Budget

Charitable Giving On A Budget

-

Money-Saving Tips That Actually Work

Money-Saving Tips That Actually Work

-

10 Ideas For Budget-Friendly Family Fun

10 Ideas For Budget-Friendly Family Fun

-

Can a Reverse Mortgage Save Your Monthly Budget?

Can a Reverse Mortgage Save Your Monthly Budget?

-

How to Get Free Money For College

How to Get Free Money For College

-

How To Have A Humble Holiday

How To Have A Humble Holiday

-

Top 4 Ways To Save For College Education

Top 4 Ways To Save For College Education

-

Can you borrow money from a life insurance policy?

Can you borrow money from a life insurance policy?

-

Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

-

Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

-

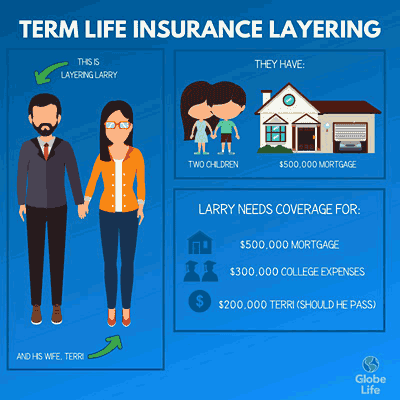

Layering Term Life Insurance Could Save You Money

Layering Term Life Insurance Could Save You Money

-

5 Tips for Finding Life Insurance That Fits Your Budget

5 Tips for Finding Life Insurance That Fits Your Budget

-

Why is Life Insurance Important for Someone Getting a Mortgage?

Why is Life Insurance Important for Someone Getting a Mortgage?

-

Can Getting a Life Insurance Quote Affect My Credit Score?

Can Getting a Life Insurance Quote Affect My Credit Score?

-

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

-

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from