Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

Whether you’re struggling financially, want to get a hold of extra cash, or simply don’t need as much coverage as you once did, you may consider cashing out your whole or universal life insurance policy, which are considered permanent policies. This can be a big decision to make, so it’s important to understand the financial impact it can have on your life.

Face Value versus Cash Value

It’s important to understand there are two components to whole life insurance. The first component is the face value, or the amount paid to your beneficiaries when you pass away. The other component is the cash value, which is funded by a portion of the premiums you pay. When you cash out a policy, you won’t receive your full premium contributions, but rather the full cash value of the policy.

Cashing Out Your Life Insurance Policy

When you cash out a permanent life insurance policy, you have the options of selling or surrendering your policy. You can then use the cash value towards paying off debt, emergencies, household repairs, loans, marriage, premium payments, retirement, and more.

The following are different ways you can go about cashing out your whole or universal life insurance policy:

Borrowing from the Cash Value

With most permanent life insurance policies, you have the option to borrow from your policy’s cash value. Most insurers have a minimum cash value requirement you must meet before you’re able to take out a loan. However, after you’ve met that requirement, you can borrow up to the full amount you’ve accumulated.

There are both benefits and drawbacks to borrowing from the cash value. Since you’re essentially borrowing money from yourself, you’re not required to make monthly payments. Your interest rates are typically lower and repayment terms are usually more flexible. However, despite these perks, it’s important that your full loan is paid back on time. If you’re unable to pay back your full amount, the policy could equity surrender:

- Outstanding policy loans

- Reduced death benefit

- Taxes

Choosing to borrow money against your life insurance policy will ultimately impact your coverage, so you should carefully consider your coverage, benefits, and premium schedule prior to borrowing money.

Cash Value Withdrawals

Instead of borrowing money and being required to pay it back, you may consider withdrawing it entirely. This option is typically best for those who need quick cash but don’t want to forfeit their coverage or ownership. While the amount you can withdraw is normally less than a policy loan, it ultimately depends on your specific policy and provider. While you’re able to swiftly take out money in the event of an emergency, drawbacks include:

- Increased premiums

- Modified endowment contracts

- Reduced death benefit amount

- Potential tax implications

Surrendering Your Policy

A more drastic option of cashing out is surrendering your policy. If you decide you want less coverage, have found a better insurance option, or need money in a pinch, this may be an option you consider. If you decide to take this route, your provider will pay out the cash value of your policy in exchange for surrendering the right to your death benefit payout. While this option can be beneficial, you should keep an eye out for:

- Giving up your benefit

- Reduced payout

- Surrender fees

- Taxes

Life Insurance Settlements

If your policy has a higher cash value, this is typically the most ideal option to consider. Life insurance settlements entail selling the right to your death benefit to a third party. The third party will then take over your premium payments as well as the ownership of your policy. In the end, the amount you’ll receive is up to them. Before selling your policy, it’s important to consider:

- Eligibility for social assistance programs

- Expensive fees and taxes

- Finding the right price

- Reduction in your family’s financial security

Alternative to Cashing Out a Policy: Personal Loans

If you’re struggling financially but don’t want to take out cash from your life insurance policy, you may consider applying for a personal loan. These loans are available at banks, credit unions, and from personal lenders. They can quickly get you access to money you need, and typically at reasonable interest rates. If you choose to take out a personal loan, it’s important you consult a financial advisor or accountant beforehand, to determine which option is the best for your specific situation.

Sources:

- Fbfs.com, Can I Cash in a Whole Life Insurance Policy?, 2019

- Finder.com, How to Cash Out Your Life Insurance Policy, 2019

You might also be interested in...

-

7 Steps To Choosing Health Insurance

7 Steps To Choosing Health Insurance

-

8 Steps to Protecting Yourself Against Identity Theft

8 Steps to Protecting Yourself Against Identity Theft

-

Life Insurance You Can Afford

Life Insurance You Can Afford

-

Are Negative Habits Keeping You From Your Financial Goals?

Are Negative Habits Keeping You From Your Financial Goals?

-

Best Retirement Tips for the Younger Generations

Best Retirement Tips for the Younger Generations

-

Calculating Life Insurance Needs

Calculating Life Insurance Needs

-

Can You Climb Your Mountain of Debt?

Can You Climb Your Mountain of Debt?

-

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

-

Eating On A Tight Budget

Eating On A Tight Budget

-

Five Costly Disasters Your Auto Insurance May Not Cover

Five Costly Disasters Your Auto Insurance May Not Cover

-

Five Practical Steps to Repair Your Credit

Five Practical Steps to Repair Your Credit

-

Five Ways to Cut Back on Your Grocery Bills

Five Ways to Cut Back on Your Grocery Bills

-

Four Bad Financial Habits You Need To Break Now

Four Bad Financial Habits You Need To Break Now

-

Getting Out of Debt: Start Taking Control of Your Finances Again

Getting Out of Debt: Start Taking Control of Your Finances Again

-

Good Financial Habits

Good Financial Habits

-

How To Deal With Debt During A Divorce

How To Deal With Debt During A Divorce

-

How To Get By On Social Security

How To Get By On Social Security

-

How to Host an Inexpensive Dinner Party

How to Host an Inexpensive Dinner Party

-

How to Rebuild Your Credit and Increase Your Score

How to Rebuild Your Credit and Increase Your Score

-

Insurance Myths

Insurance Myths

-

Is it Worth it to Get a Credit Monitoring Service?

Is it Worth it to Get a Credit Monitoring Service?

-

Making Life Transitions

Making Life Transitions

-

The Pros And Cons Of HARP Refinance

The Pros And Cons Of HARP Refinance

-

Ten Essential Tips for Managing Your Personal Finances

Ten Essential Tips for Managing Your Personal Finances

-

The Importance of Life Insurance You Can Afford

The Importance of Life Insurance You Can Afford

-

Top Financial Mistakes That Can Spoil Your Retirement

Top Financial Mistakes That Can Spoil Your Retirement

-

Top Ten Cheap Ways to Keep Your Kids Entertained

Top Ten Cheap Ways to Keep Your Kids Entertained

-

What's the Point of Points?

What's the Point of Points?

-

4 Ways To Treat Rosacea Naturally

4 Ways To Treat Rosacea Naturally

-

4 Natural Remedies For Varicose Veins

4 Natural Remedies For Varicose Veins

-

8 Ways To Grocery Shop On A Budget

8 Ways To Grocery Shop On A Budget

-

The Holidays On A Budget

The Holidays On A Budget

-

Tips For Women On Saving For Retirement

Tips For Women On Saving For Retirement

-

Home Remedies For Heartburn

Home Remedies For Heartburn

-

8 Great Uses For Tea Tree Oil

8 Great Uses For Tea Tree Oil

-

The Best Natural Treatments For Sinus Sufferers

The Best Natural Treatments For Sinus Sufferers

-

Old Medical Hacks That Still Work

Old Medical Hacks That Still Work

-

How To Shop Healthy On A Budget

How To Shop Healthy On A Budget

-

The Best Home Remedies For Sunburn

The Best Home Remedies For Sunburn

-

Charitable Giving On A Budget

Charitable Giving On A Budget

-

Money-Saving Tips That Actually Work

Money-Saving Tips That Actually Work

-

10 Ideas For Budget-Friendly Family Fun

10 Ideas For Budget-Friendly Family Fun

-

Can a Reverse Mortgage Save Your Monthly Budget?

Can a Reverse Mortgage Save Your Monthly Budget?

-

How to Get Free Money For College

How to Get Free Money For College

-

How To Have A Humble Holiday

How To Have A Humble Holiday

-

Top 4 Ways To Save For College Education

Top 4 Ways To Save For College Education

-

Can you borrow money from a life insurance policy?

Can you borrow money from a life insurance policy?

-

Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

-

Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

-

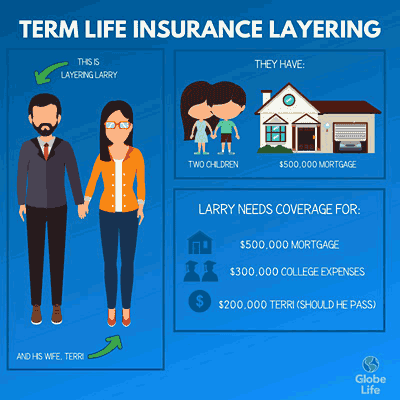

Layering Term Life Insurance Could Save You Money

Layering Term Life Insurance Could Save You Money

-

5 Tips for Finding Life Insurance That Fits Your Budget

5 Tips for Finding Life Insurance That Fits Your Budget

-

Why is Life Insurance Important for Someone Getting a Mortgage?

Why is Life Insurance Important for Someone Getting a Mortgage?

-

Can Getting a Life Insurance Quote Affect My Credit Score?

Can Getting a Life Insurance Quote Affect My Credit Score?

-

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

-

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from