Layering Term Life Insurance Could Save You Money

One of the most common questions we hear in the insurance industry is, “How much coverage do I need?”

When it comes to life insurance, there are two different types of policies: whole life and term life. A whole life insurance policy lives as long as you do while a term life insurance policy is active for a certain period of time. The “one size fits all” phrase is not applicable to life insurance—coverage should be customized to where you are in your life. Your insurance needs change as your life goes on.

What Does it Mean to Layer Your Life Insurance Policies?

Layering, or laddering, is a technique that has become quite popular in the life insurance industry. It occurs when a consumer buys a few different term life policies with different term lengths rather than one whole life policy, or one large term life policy. In some instances, the layering technique can save policyholders almost 30%!1

We see layering policies when consumers have multiple reasons to buy a term life policy such as covering a mortgage, leaving dependents with a benefit, or general coverage for “just in case” purposes.

Layering life insurance is not recommended for everyone. It may be unjustifiable for a single male in his mid-20s who makes $55,000 a year to take out three term life insurance policies. Not only would it be questionable to the insurance company why this person would need so much coverage, but they would also have a concern with his ability to consistently pay all the premiums.

Cons of Layering Your Life Insurance Policies

- Most insurance policies have a few different fees that cover things such as sales charges, mortality and expense risk charges, monthly per thousand charges, or general administration fees. When you ladder your insurance, you may be subject to paying multiple fees for each policy.

- While it’s encouraged to get a head start on your coverage needs, if you aren’t sure of your future financial obligations, you could be excessively spending on multiple policies.

- Having less insurance in your later years could backfire if you need additional money to purchase another house or deal with an emergency.

- Should your spouse ever need to file a claim, he or she will need to file multiple claims and present a death certificate several times since you would have multiple policies.

Pros of Layering Life Insurance Policies

- Because term life insurance is temporary and typically has no cash value, it can cost three to 10 times less than a whole life insurance policy.2

- A term life policy tends to be more transparent because it offers coverage over a set period of time, which consumers pay in previously-defined regular payments. Term life insurance gives you one product that does one thing.

- Term life policies give the consumer more control over his or her purchased coverage. Additionally, when your financial obligations change as your life goes on, you can customize your coverage to best fit your needs.

Layering Term Life Example

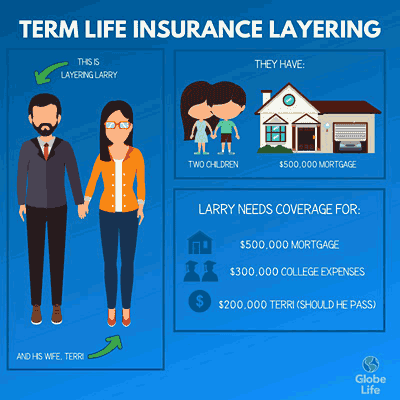

Let’s see how our fictional friends Larry and Terri layered their term life insurance policies. Larry and Terri are married and in their mid-30s with two young children and a suburban home purchased at $500,000. Larry is a successful real estate agent while Terri provides child-care for their two young children.

Larry is looking into life insurance and needs:

- $500,000 for his mortgage with 10 years left

- $300,000 for his two children’s college expenses ($150,000 each)

- $200,000 in the event of his death so Terri will be taken care of

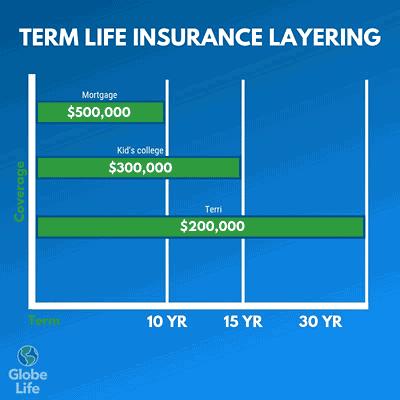

We encourage Larry to layer three term life policies as shown below:

We encourage Larry to layer three term life policies as shown below:

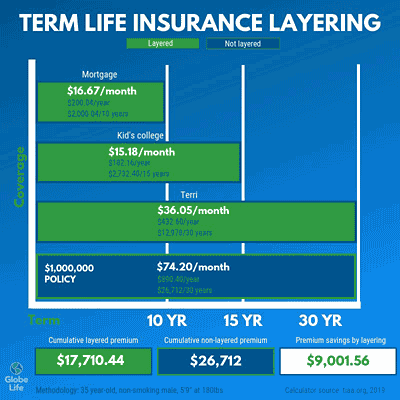

Instead of purchasing one term life policy for $1,000,000 for 30 years at a fixed rate, we encourage Larry to purchase three separate term life policies:

- One policy for $500,000 for 10 years

- One policy for $300,000 for 15 years

- One policy for $200,000 for 30 years

When Larry purchases three separate policies versus one large policy, he saves almost 34%! Let’s see how this is possible.

Term life insurance layering could possibly be a sound investment for some families, especially if their insurance needs decline as they age. However, the layering strategy could be highly complicated for those just starting out. When layering your life insurance, we highly recommend getting professional help to guide you through the process and ensure you’re getting the best coverage at the best prices.

2. NerdWallet, 2017

You might also be interested in...

-

7 Steps To Choosing Health Insurance

7 Steps To Choosing Health Insurance

-

8 Steps to Protecting Yourself Against Identity Theft

8 Steps to Protecting Yourself Against Identity Theft

-

Life Insurance You Can Afford

Life Insurance You Can Afford

-

Are Negative Habits Keeping You From Your Financial Goals?

Are Negative Habits Keeping You From Your Financial Goals?

-

Best Retirement Tips for the Younger Generations

Best Retirement Tips for the Younger Generations

-

Calculating Life Insurance Needs

Calculating Life Insurance Needs

-

Can You Climb Your Mountain of Debt?

Can You Climb Your Mountain of Debt?

-

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

Be Careful! You Just Might Get What You Paid For With These Cheap Life Services

-

Eating On A Tight Budget

Eating On A Tight Budget

-

Five Costly Disasters Your Auto Insurance May Not Cover

Five Costly Disasters Your Auto Insurance May Not Cover

-

Five Practical Steps to Repair Your Credit

Five Practical Steps to Repair Your Credit

-

Five Ways to Cut Back on Your Grocery Bills

Five Ways to Cut Back on Your Grocery Bills

-

Four Bad Financial Habits You Need To Break Now

Four Bad Financial Habits You Need To Break Now

-

Getting Out of Debt: Start Taking Control of Your Finances Again

Getting Out of Debt: Start Taking Control of Your Finances Again

-

Good Financial Habits

Good Financial Habits

-

How To Deal With Debt During A Divorce

How To Deal With Debt During A Divorce

-

How To Get By On Social Security

How To Get By On Social Security

-

How to Host an Inexpensive Dinner Party

How to Host an Inexpensive Dinner Party

-

How to Rebuild Your Credit and Increase Your Score

How to Rebuild Your Credit and Increase Your Score

-

Insurance Myths

Insurance Myths

-

Is it Worth it to Get a Credit Monitoring Service?

Is it Worth it to Get a Credit Monitoring Service?

-

Making Life Transitions

Making Life Transitions

-

The Pros And Cons Of HARP Refinance

The Pros And Cons Of HARP Refinance

-

Ten Essential Tips for Managing Your Personal Finances

Ten Essential Tips for Managing Your Personal Finances

-

The Importance of Life Insurance You Can Afford

The Importance of Life Insurance You Can Afford

-

Top Financial Mistakes That Can Spoil Your Retirement

Top Financial Mistakes That Can Spoil Your Retirement

-

Top Ten Cheap Ways to Keep Your Kids Entertained

Top Ten Cheap Ways to Keep Your Kids Entertained

-

What's the Point of Points?

What's the Point of Points?

-

4 Ways To Treat Rosacea Naturally

4 Ways To Treat Rosacea Naturally

-

4 Natural Remedies For Varicose Veins

4 Natural Remedies For Varicose Veins

-

8 Ways To Grocery Shop On A Budget

8 Ways To Grocery Shop On A Budget

-

The Holidays On A Budget

The Holidays On A Budget

-

Tips For Women On Saving For Retirement

Tips For Women On Saving For Retirement

-

Home Remedies For Heartburn

Home Remedies For Heartburn

-

8 Great Uses For Tea Tree Oil

8 Great Uses For Tea Tree Oil

-

The Best Natural Treatments For Sinus Sufferers

The Best Natural Treatments For Sinus Sufferers

-

Old Medical Hacks That Still Work

Old Medical Hacks That Still Work

-

How To Shop Healthy On A Budget

How To Shop Healthy On A Budget

-

The Best Home Remedies For Sunburn

The Best Home Remedies For Sunburn

-

Charitable Giving On A Budget

Charitable Giving On A Budget

-

Money-Saving Tips That Actually Work

Money-Saving Tips That Actually Work

-

10 Ideas For Budget-Friendly Family Fun

10 Ideas For Budget-Friendly Family Fun

-

Can a Reverse Mortgage Save Your Monthly Budget?

Can a Reverse Mortgage Save Your Monthly Budget?

-

How to Get Free Money For College

How to Get Free Money For College

-

How To Have A Humble Holiday

How To Have A Humble Holiday

-

Top 4 Ways To Save For College Education

Top 4 Ways To Save For College Education

-

Can you borrow money from a life insurance policy?

Can you borrow money from a life insurance policy?

-

Cashing Out a Life Insurance Policy

Cashing Out a Life Insurance Policy

-

Can I Sell My Whole Life Insurance Policy?

Can I Sell My Whole Life Insurance Policy?

-

Layering Term Life Insurance Could Save You Money

Layering Term Life Insurance Could Save You Money

-

5 Tips for Finding Life Insurance That Fits Your Budget

5 Tips for Finding Life Insurance That Fits Your Budget

-

Why is Life Insurance Important for Someone Getting a Mortgage?

Why is Life Insurance Important for Someone Getting a Mortgage?

-

Can Getting a Life Insurance Quote Affect My Credit Score?

Can Getting a Life Insurance Quote Affect My Credit Score?

-

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

How Much Should I Pay for Whole Life Insurance vs Term Life Insurance?

-

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Term Life Insurance for Young Adults: When Is the Right Time to Buy?

Insurance products are available in New York from

Insurance products are available in New York from  Insurance products are available in your state from

Insurance products are available in your state from

Corey A. Jones is Globe Life’s Senior Vice President of Branding and Digital Marketing. He has worked in the insurance industry for nearly 20 years. In addition to holding a degree in Organizational Leadership from Southern Nazarene University, he is also a Fellow of the Life Management Institute through LOMA, an international education and trade association for insurance and financial services.

Corey A. Jones is Globe Life’s Senior Vice President of Branding and Digital Marketing. He has worked in the insurance industry for nearly 20 years. In addition to holding a degree in Organizational Leadership from Southern Nazarene University, he is also a Fellow of the Life Management Institute through LOMA, an international education and trade association for insurance and financial services.